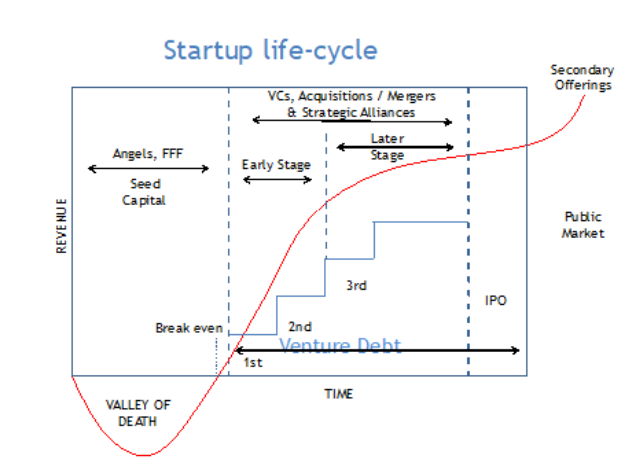

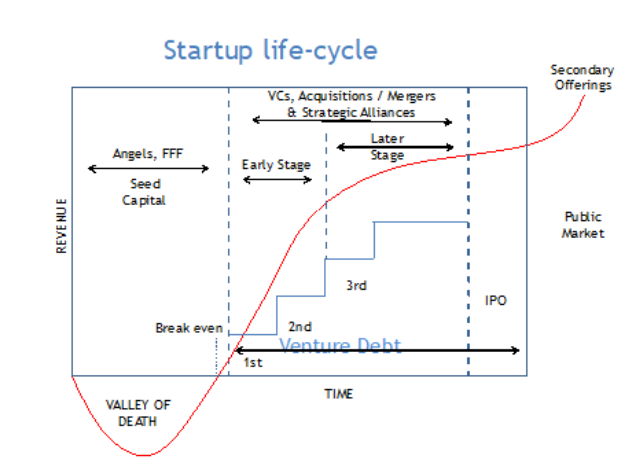

Venture debt was introduced in India 15 years ago. However, it has gained traction in the last decade. In these years, the Indian debt market for startups has been dominated by the likes of funds such as Alteria capital, Innoven capital and Trifecta capital. These firms combined have deployed approximately $300 mn (INR 2,200 crores) in startups such as Bigbasket, Curefit, Ninjacart, Dunzo and Lendingcart to name a few. In the last 6 years itself, approximately $4 bn of debt has been deployed across 150+ deals in India.

Read article on Venture Debt in Economic Times prime (subscription required).

Also covered by Invest India. More at kauffman. And a legal perspective from Illinois.

Read article on Venture Debt in Economic Times prime (subscription required).

Also covered by Invest India. More at kauffman. And a legal perspective from Illinois.

No comments:

Post a Comment